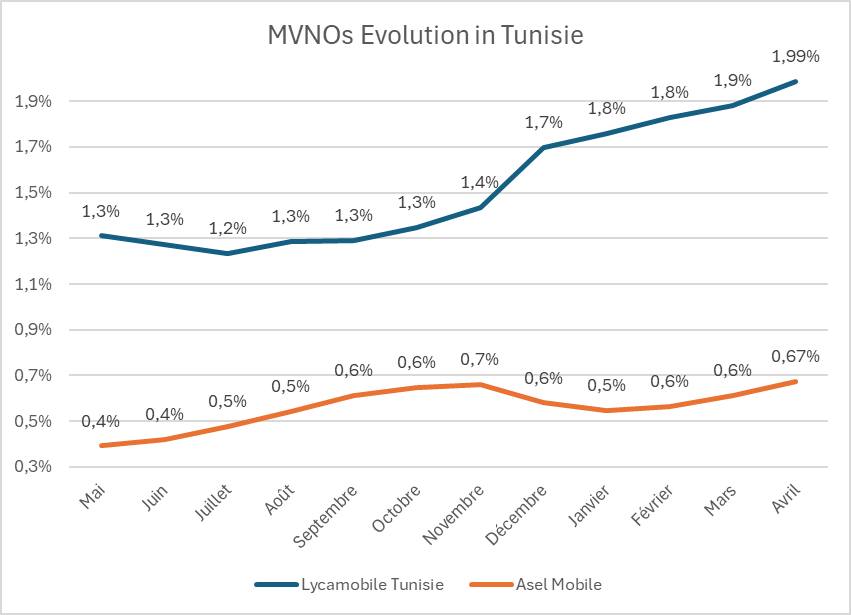

A continent-hopping journey from Latin America to North Africa to take a look at MVNOs in Tunisia. I must start by saying that there are some other licenses granted, but currently in the report of the Tunisian regulator (L’Instance Nationale des Télécommunications (INT)) two MVNOs appear, Lycamobile Tunisie and Asel Mobile.

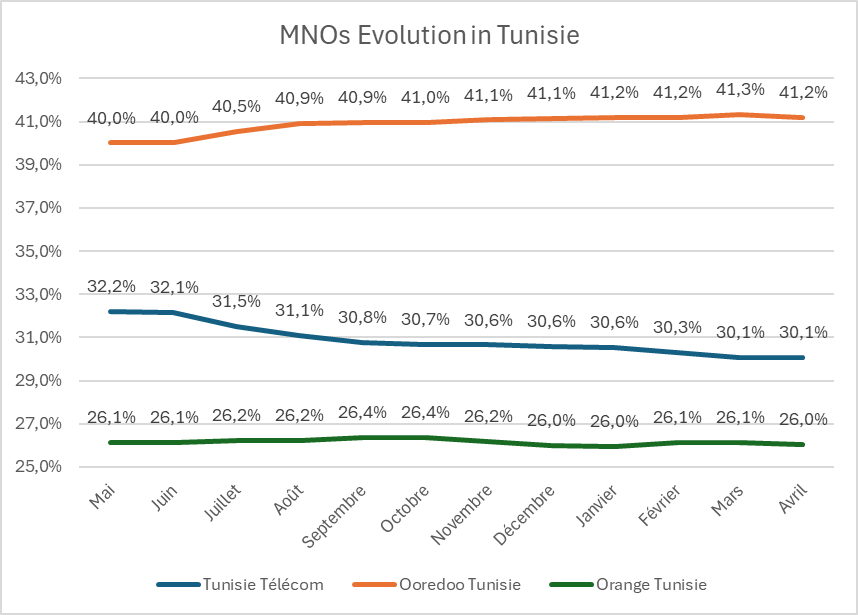

The first thing to note is that in the twelve months analysed (May 2023 to April 204) there is a net decrease of 284,035 mobile phone users, while the 2 MVNOs together grew by 165,389.

Once again, as in all the markets we are analysing, growth is associated with MVNOs.

It should not be overlooked that not all MNOs have a net loss of users, as Ooredoo Tunisie gained 10,886 users in this period, which combined with the overall decline increases its market share from 40.0% to 41.2%, making it the dominant operator.

During this period, Tunisian MVNOs went from 1.58% to a very interesting 2.66%.

In conclusion, it seems clear that the opening of competition to MVNOs in all the markets we are analysing leads to a flight of users from network operators to virtual operators with a greater capacity to attract customers in their offerings, whether due to their ability to reduce costs or to innovate in the services offered.

Hopefully, new players will emerge in the near future and users will continue to benefit from increased competition.